Forest sector growth forecasts downgraded for next year

Published : 27 Oct 2019, 23:58

Weaker growth of the global economy and lower demand will reduce the production and export volumes of many forest industry products this and next year, according to the Natural Resources Institute Finland (Luke).

In addition, felling volumes of industrial wood will decrease, stumpage prices of roundwood will be lower and stumpage earnings will turn to a decline after the 2018 peak year, said a recent press release of Luke.

Oversupply in key export markets is reflected in the average export price of Finland’s sawnwood. The average export price is expected to decrease by 8% in 2019. Production will be limited at sawmills during the rest of the year and during winter due to lower demand for sawnwood in Finland, in addition to export problems. The production of sawnwood will decrease by 2%, whereas the export volume will remain at the 2018 level.

In 2020, the decrease in the average export price of sawnwood is expected to continue, albeit more slowly than this year. Export and production volumes of sawnwood are expected to decrease further from this year.

The average export price of plywood is estimated to strengthen by 1% this year. Instead, production and exports are expected to decrease, as production has been adapted in accordance with the tightened market situation. No major changes in plywood exports or production are expected next year.

The average export price of plywood is estimated to strengthen by 1% this year. Instead, production and exports are expected to decrease, as production has been adapted in accordance with the tightened market situation. No major changes in plywood exports or production are expected next year.

In 2019, pulp production will increase by 1% and pulp exports by 8% from the previous year, mainly as a result of previous increases in capacity. Next year, exports will grow more slowly and the production volume will decrease slightly. However, the export volume is record-high. High pulp storage volumes and decreasing demand in China and Europe mean that the average export price of pulp will decrease by 16% this year. Even though the price will turn to a slight increase next year, the average export price will remain lower than this year’s average price.

In 2019, the production and export volumes of paper will decrease by 7% as a result of lower demand and production capacity. Next year, production and exports will decrease even more due to shutdowns of paper machines. The export price will decrease next year as demand continues to slow down and the price of pulp decreases.

The production and exports of paperboard will decrease by roughly 2% this year due to lower demand. However, the average export price will increase slightly. No significant changes in production and export volumes or export prices are expected next year. The outlook for folding boxboard, important to Finland, is relatively stable.

Oversupply in key export markets is reflected in the average export price of Finland’s sawnwood. The average export price is expected to decrease by 8% in 2019. Production will be limited at sawmills during the rest of the year and during winter due to lower demand for sawnwood in Finland, in addition to export problems. The production of sawnwood will decrease by 2%, whereas the export volume will remain at the 2018 level.

In 2020, the decrease in the average export price of sawnwood is expected to continue, albeit more slowly than this year. Export and production volumes of sawnwood are expected to decrease further from this year.

The average export price of plywood is estimated to strengthen by 1% this year. Instead, production and exports are expected to decrease, as production has been adapted in accordance with the tightened market situation. No major changes in plywood exports or production are expected next year.

In 2019, pulp production will increase by 1% and pulp exports by 8% from the previous year, mainly as a result of previous increases in capacity. Next year, exports will grow more slowly and the production volume will decrease slightly. However, the export volume is record-high. High pulp storage volumes and decreasing demand in China and Europe mean that the average export price of pulp will decrease by 16% this year. Even though the price will turn to a slight increase next year, the average export price will remain lower than this year’s average price.

In 2019, the production and export volumes of paper will decrease by 7% as a result of lower demand and production capacity. Next year, production and exports will decrease even more due to shutdowns of paper machines. The export price will decrease next year as demand continues to slow down and the price of pulp decreases.

The production and exports of paperboard will decrease by roughly 2% this year due to lower demand. However, the average export price will increase slightly. No significant changes in production and export volumes or export prices are expected next year. The outlook for folding boxboard, important to Finland, is relatively stable.

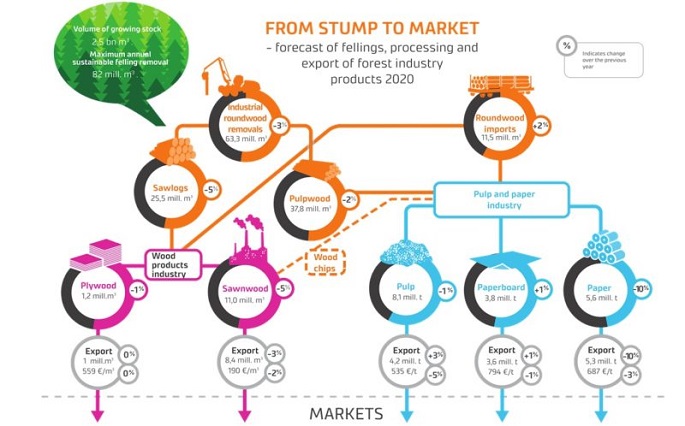

Due to the downward trend and lower production volumes in the wood products industry, the average stumpage prices of logs will decrease by 3–7% this year. The production of pulp and paperboard remaining at a high level will maintain the stumpage prices of pulpwood in an increase of 0–2%. Industrial roundwood removals will decrease by 5% to slightly above 65 million cubic metres. Imports of roundwood will remain at the 2018 level.

“Next year, industrial roundwood removals will decrease by another 3%. If the decrease in the production of sawnwood continues, stumpage prices will decrease by 2–3% from this year,” said Jussi Leppänen, research scientist of Luke.

Lower demand for paper and stopped growth in pulp and paperboard production will reduce the stumpage prices of pulpwood by 1–2%. Roundwood imports are expected to increase slightly from this year.

This year, gross stumpage earnings from non-industrial private forestry will decrease to EUR 2 billion, and the total amount is expected to continue its slight decrease next year. The operating profit of non-industrial private forests is expected to decrease below EUR 140 per hectare in 2019. In 2020, the operating profit will decrease below EUR 130 per hectare.

The prices of emissions rights have nearly tripled during the past year. This supports the competitiveness of forest chips, bark and sawdust in heat production.

The use of forest chips is expected to increase by roughly 2% this year and next year. The average production price of forest chips will increase slightly. The domestic consumption and production of wood pellets is expected to increase at an annual rate of a few per cent.